With the announcement of new tax measures in the coalition agreement of the federal government De Wever I, SMEs will once again be able to use declining balance depreciation. This means that companies can record higher depreciation expenses in the early years of an investment, providing them with a tax advantage. But what exactly is declining balance depreciation? And how does it compare to the traditional straight-line method?

In this Feniks article, we explain the key differences and examine the benefits of this new measure.

Straight-Line vs. Declining Balance Depreciation: What’s the Difference?

With straight-line depreciation, the investment cost is evenly distributed over the useful life of the asset. This means that the same amount is depreciated each year. In the case of a property worth €500,000 over 20 years, the annual depreciation amounts to €25,000.

Declining balance depreciation, on the other hand, allows for a higher percentage to be depreciated in the initial years. This percentage is applied to the remaining book value, meaning that depreciation expenses are higher at the start and decrease over time. This can offer a significant tax advantage, as taxable income in the early years of the investment will be lower.

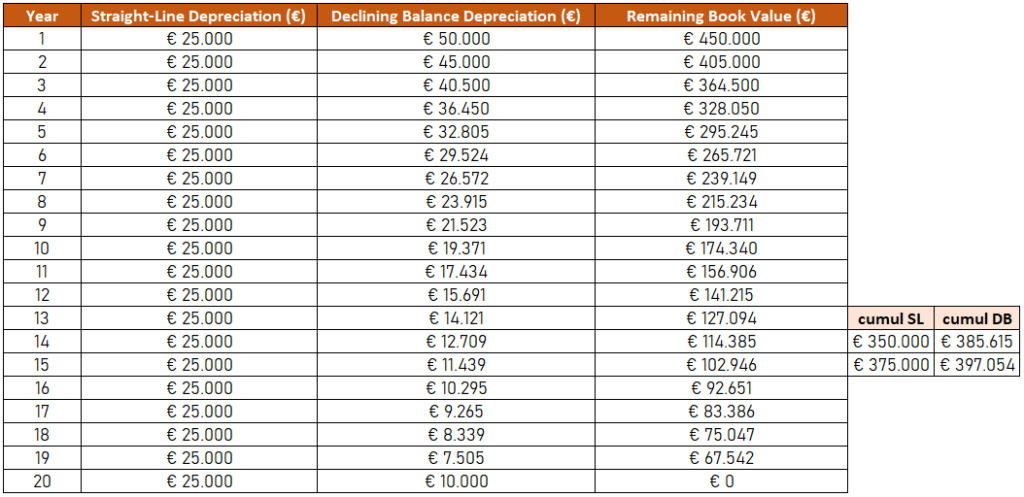

Below is a comparison between both methods for a property worth €500,000:

When Do Straight-Line and Declining Balance Depreciation Cross Over?

The table shows that declining balance depreciation is significantly higher than the straight-line method in the early years. Around year 14-15, the amounts start to converge, and from that point on, declining balance depreciation is no longer more advantageous.

Benefits of Declining Balance Depreciation

- Faster Tax Savings

By recording higher depreciation expenses in the early years, you reduce your taxable income more quickly. - Improved Cash Flow

Lower taxes in the initial years mean more funds available for investments or operational costs. - Flexibility

This system allows investments to be financially depreciated more quickly, which is beneficial in a dynamic business environment.

Is Declining Balance Depreciation Beneficial for Your Business?

The choice between straight-line and declining balance depreciation depends on your specific situation and cash flow needs. Want to know which method is most advantageous for your company?

Contact Feniks Accountants. We are happy to help you with a strategic approach to your investments and tax optimization.

📩 Get in touch with us today and let’s optimize your financial future together!